Ogilvie vs Almaraz-Guzman Ratings in 2015

by Stephen Schneider, principal at ScanFiles, Inc. and DocuCents

INTRODUCTION

In 2003, RAND and CHSWC sent a report to the legislature that said permanent disability benefits in California were barely adequate under the 2/3 replacement level standard, and below many other states. This was mostly due to the poor return to work performance of California employers. As a result of this study, the legislature enacted several key changes to the system in SB 899, and part of that was a move to the AMA Guides as the description of injuries, and an empirical, formula-based method for calculating the percentage of permanent disability. The method proposed in LC 4660 was to be a fair and impartial formula that would forecast what the injured employee could expect as far as diminished future earning capacity (DFEC) caused by the work-related injury. Unfortunately, in 2004 while formulating the SB 899 mandated PDRS, the administrative director lacked the empirical data necessary to execute on the promise of Labor Code Section 4660. The administrative director simply did the best she could at the time, but the result was a FLAWED PDRS that by all accounts – including the DWC and CHSWC – slashed permanent disability ratings by OVER 50%. Since that time, the Administration has left it up to the applicant attorneys to rebut the flawed PDRS if they expect their clients to receive an accurate measurement of their permanent disability.

Last week, I introduced a method for rebutting the DFEC Adjustment Factors in Table A of the 2005 PDRS that can be used to rebut the schedule for cases with dates of injury between 2005 and 2012. I think most attorneys had all but given up on the Ogilvie-style “FEC Adjustment Factor” rebuttal method after the Court Of Appeal Ogilvie III decision. However, last week I encouraged all applicant attorneys to read my post and give my version of this method a try.

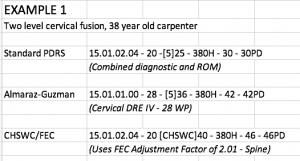

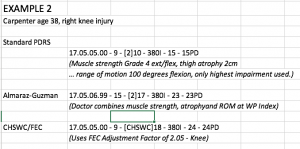

This week, I want to give you some EXAMPLES comparing the VALUES of the permanent disability awards for several common scenarios using the standard PDRS, the CHSWC “adjustment factor” rebuttal method I discussed last week, and the Almaraz-Guzman style rebuttal method.

THE DIFFERENT METHODS

- Almaraz-Guzman: The Almaraz-Guzman style rebuttal method attacks the WPI portion of the rating. This method involves obtaining a medical report from a doctor that goes OUTSIDE of the standard AMA Guides rating procedures and chapter for a particular impairment, and uses ANY chapter within the “four corners of the AMA Guides” that in his/her opinion MOST ACCURATELY reflects the injured employee’s impairment (See “Conclusion” on page 35 of the decision). You then take the medical report with the non-standard WPI and rate it “normally” using the 2005 PDRS. This usually provides significantly higher percentages of permanent disability than otherwise available under the AMA Guides and the schedule alone.

- CHSWC FEC Adjustment Factors: Everything you would want to know about the CHSWC FEC Adjustment Factor rebuttal method is in last week’s post. The CHSWC method involves rebutting the diminished future earning capacity “adjustment factor” that appears as Table A in the 2005 PDRS with a more appropriate and accurate multiplier. The method can be used with ANY medical report using a standard WPI.

KEY DIFFERENCES

- Almaraz-Guzman: The key difference between the two is with an Almaraz-Guzman rating, the attorney is entirely dependent upon a doctor to provide the rebuttal evidence (the rebuttal WPI). That usually means (a) maintaining medical control and encouraging the injured employee to use a PTP that writes Almaraz-Guzman reports, or, (b) deposing the network PTP and convincing him/her to write a supplemental report, or, (c) getting a panel QME (or AME) to provide an Almaraz-Guzman rating, or, (d) go out and buy your own Almaraz-Guzman rating from an outside doctor (at the injured worker’s expense).

- CHSWC FEC Adjustment Factors: This method requires having the Rater use the CHSWC FEC Adjustment Factor table to rate the standard medical report from ANY doctor to adjust the PDRS standard rating up to a more appropriate value. The friction with this method is there is no case law directly supporting it yet, although in my opinion the Ogilvie III Court Of Appeal decision all but describes this method. So, to employ this method you will have to blaze your own trail with the Judge and convince him/her of the merits of this method. Just imagine though: you can use this with ANY doctor’s report.

DIFFERENCE IN RATINGS

In Example 1 above, the CHSWC FEC Adjustment Factor method provides the highest percentage of permanent disability, at 46%. The Almarez-Guzman method nets a 42%, and the standard PDRS rating nets only a 30%.

In Example 2 above, the CHSWC FEC Adjustment Factor method again provides the highest percentage of permanent disability, providing a 24%… but the Almaraz-Guzman method provides a very close 23%. The standard PDRS provides a 15%.

In Example 3 above, the Almaraz-Guzman method provides a much higher permanent disability rating – 27% – than the others because the Hernia section of the AMA Guides was used. The CHSWC FEC method provides a solid bump over the standard method, but at only 18%, it’s much lower than the Almarez-Guzman rating. The standard PDRS method provide a 12% percentage of permanent disability.

PROS AND CONS OF THE REBUTTAL METHODS

There are some definite differences in the rebuttal methods described here. While I didn’t discuss it so far, there is a THIRD method available when the injured employee is 100% disabled and not amenable to rehabilitation. This is called the LeBoeuf method. You can read my post about THIS type of rebuttal rating here (Dahl).

Here are the pros and cons of the three methods:

Almaraz-Guzman Rebuttal Method

Pros:

- Authorized by En Banc WCAB decision

- Provides much higher ratings than standard

- DEU and WCJs are familiar with this method and will support it if done properly

- Can be used on injures from 2005 to present, including 2013 and later dates of injury

Cons:

- Requires a doctor well trained in writing Almarez-Guzman specific reports

- May not be easy to convince a network PTP or panel QME to write an Almarez-Guzman report

- The ability to use private doctor reports as evidence may not last much longer

CHSWC FEC Adjustment Factor Method

Pros:

- Provides much higher ratings than standard

- Can be used on ANY medical report written by even the most conservative network doctors and panel QMEs

- Simple to use – just replace Table A in the schedule with the CHSWC Chart

Cons:

- There is no direct case law supporting this method yet, but the Ogilvie III Court Of Appeal decision strongly hints at this method. Read my blog post here for the details.

- WCJs may be reluctant to cooperate with this method until there is specific case law detailing how it should be used

- It only may be used on dates of injury between 2005 and 2012 (pre-SB863). Labor Code Section 4660.1, enacted as part of SB 863, no longer refers the Diminished Future Earning Capacity adjustment to the DWC’s schedule, so it may not be subject to rebuttal

LeBoeuf Method

Pros:

- Provides 100% percentage of permanent disability

- Supported by Ogilive and Dahl Court Of Appeal decisions

- A vocational expert can be hired to provide the necessary evidence, and the cost adjusted between the parties

Cons:

- Only available when the injured employee is 100% disabled and not amenable to any rehabilitation – partial permanent disability cannot be calculated with this method

- Requires a strong vocational expert to provide the necessary evidence

- Can be pricey

CONCLUSION

The proverbial “walls” may be closing in on the California injured employees’ right to receive an ACCURATE percentage of permanent disability measurement. By “accurate”, I mean anything CLOSE to a measurement that meets the standard in Labor Code Section 4658 of “percentage of disability to total disability.” In 2013, SB 863 changed the way permanent disability is calculated and no longer includes a “Diminished Future Earning Capacity” goal or standard. Labor Code Section 4660.1 merely states that account shall be taken of the nature of the physical injury, which is again described as the AMA Guides 5th Edition, but this version of 4660 provides a STRAIGHT multiplier of 1.4, and does not describe this as having anything to do with a loss of future earning capacity. This likely eliminates the “CHSWC Method” that I’ve described here for 2013 dates of injury and beyond. I should point out that the CHSWC method I’ve described provides a Spine multiplier of 2.01, which would provide a dramatic increase in rating over SB 863’s 1.4.

Almaraz-Guzman is not only alive under SB 863, but has been incorporated into the code section at LC 4660.1(h). However, the courts have been signaling an increasingly narrow view on getting a medical report into evidence that isn’t provided by the PTP (who is often in the employer’s network), AME or panel QME. This will put friction and complication on the injured employee’s ability to find a doctor willing and able to provide an Almarez-Guzman style medical report and WPI rating that is substantial evidence – and the WCJ will accept.

It will be quite interesting to see how all this plays out in the next 24-36 months. It’s common knowledge in the industry that the 2005 PDRS was not based on the correct rating data and therefore reduced measurements of permanent disability by a whopping 50+% from what was already described by RAND in 2003 as barely adequate. Given the ample data provided by CHSWC, DWC and RAND, SB 863’s changes to Labor Code Section 4660.1 only gave back to injured employees a small fraction of that 50% cut they received back in 2005, and the world of “rebuttal ratings” to bring the values back up to anything near “accurate” seems – to me, anyway – at grave risk.