Sales Tax Disputes Further Erode Copy Service Fees

by Stephen Schneider, principal at ScanFiles, Inc. and DocuCents

Stephen is not an attorney or a tax professional.

INTRODUCTION

The Copy Service Fee Schedule is going on it’s THIRD month in use now, and word on the street is that one of the BIGGEST areas of DISPUTE is related to SALES TAX. For example, the fee schedule at C.C.R. 9983(a) allows a “FLAT” $180 when records are produced, but AFTER SALES TAX IS ADDED, the total invoice ends up being around 10% higher than $180. Confused by the fee in excess of $180, the Bill Reviewer or Claims Adjuster pays the copy service only $180, and disputes the remaining sales tax amount.

SPOILER ALERT: The California Sales Tax regulations clearly define copies of RECORDS as TAXABLE to ALL purchasers, and CCR Section 9983 (Fee Schedule) very clearly states in the opening sentence that the sales tax is NOT already included in the defined fees. Therefore, copy services are responsible for charging sales tax “on top of” the defined flat fees in the Fee Schedule, and employers/carriers are liable under the sales tax regulations to REIMBURSE the copy providers for that tax.

That’s the answer, but it’s not what makes this a story…

SALES TAX DISPUTES FURTHER ERODE COPY SERVICE FEES

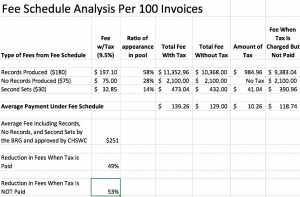

In a prior blog post (click here), I postulated that the average copy service payment under the fee schedule will be between $129 and $150 (depending on if you include second sets in your calculation), and that’s BEFORE sales tax is added. The copy service must PRE-PAY the sales tax on their invoices, so when employers/carriers underpay those invoices by another 9%-10% because they dispute the sales tax it’s the same as reducing copy fees by another 9.5%.

If you do the math on the ratios of record invoices ($180) vs no records invoices ($75) vs second sets ($30), and how the pre-paid sales tax plays into the overall value of those fees, the NET EFFECT of the disputed sales tax is an average payment under this fee schedule of only $118.74. That’s a whopping 53% reduction from the $251 average fee paid prior to the fee schedule as calculated by BRG and CHSWC (and the BRG data DID include sales tax and second sets). Of course, not EVERY Payer is underpaying copy services in this way, so the picture isn’t as bad as all that, but from what I hear it’s happening on a significant percentage of invoices.

So, that’s the emotional STORY in this post… now let’s review what the regulations on the subject of SALES TAX for copy services say, AND TRY TO CLEAR THIS UP.

SALES TAX REGULATIONS REQUIRE TAXES ON COPIED RECORDS

Regulation 1528 of Article 3 of the Sales and Use Tax Regulations for California defines the sales tax requirements that Professional Photocopiers and their Payers must follow when delivering records on tangible media such as paper, CDs, USB sticks, and the like. Click HERE to read the sales tax code on this point for yourself.

Subsection (b) (1) GENERAL RULES, states “Tax applies to sales of photocopies of records.” It then goes on to state that when Photocopiers provide records to a requestor, including records produced under a Subpoena or Authorization, the services of the Photocopier are ENTIRELY TAXABLE. This regulation is very specific and matches perfectly to the types of services defined in the DWC’s Fee Schedule.

As a side note, subsections (b)(2), (b)(3) and (b)(4) of Section 1528 of Article 3 of the Sales and Use Tax Regulations define sub-services often performed by a Professional Photocopier that are NON-taxable when appearing separately on the invoice. These include subpoena preparation and service, witness fees that are paid (including ROI fees), and transcriptions or excerpts. However, the administrative director chose to define the FEES for Photocopiers in the regulations as mostly FLAT RATE fees, with all the sub-services “bundled” together, so none of these sub-services may be separated out on the invoice and provided without sales tax. Thus, the ENTIRE FLAT FEE for most of the services defined in the FEE SCHEDULE are fully TAXABLE under the Sales Tax Regulations, including excess pages. This is an unfortunate side-effect of the particular drafting of this “bundled” fee schedule.

I’ll provide some considerations below for avoiding sales tax on the flat fees, but first let’s look at what the tax regulations say about employers/carriers having to PAY the sales tax on an otherwise valid medical-legal expense…

PURCHASERS OF RECORDS AS TANGIBLE PERSONAL PROPERTY MUST PAY THE TAX TO THE SELLER

Regulation 1685 of Article 17 of the state Sales Tax Regulations states that: (a) Purchasers and lessees of tangible personal property, the storage, use, or other consumption of which is subject to the use tax, must pay the tax: (1) To the person from whom such property is purchased or leased, if such person holds a seller’s permit or a Certificate of Registration—Use Tax.

The employer/carrier is responsible for PAYMENT of the services of a medical-legal provider, so the employer/carrier MUST PAY THE SALES TAX required under the tax regulations for copying and related services. The Payer cannot argue that the sales tax IS INCLUDED ALREADY in the Fee Schedule because C.C.R. Section 9983 (click here) states: “The reasonable maximum fees, not including sales tax, payable for copy and related services are as follows:…”

That’s it… end of story. Sales tax on a copy service invoice under the fee schedule must have sales tax added to the flat fees, the copy service must PAY that tax to the FTB once the invoice is issued, and the employer/carrier must REIMBURSE the copy service for that tax as part of the medical-legal expense under Labor Code Section 4620/4622.

Okay, that seems pretty clear as far as records delivered on PAPER, CDs, and USB sticks… but what about purely ELECTRONIC delivery of records through the “cloud”?

ELECTRONICALLY DELIVERED RECORDS ARE NOT SUBJECT TO TAX

Tangible property, which is what sales tax is based on, is something you can touch, such as paper, CDs, thumb drives, and the like. If you ship it, mail it, or otherwise deliver something in an ENVELOPE or PACKAGE, then it is TANGIBLE personal property. Therefore, if a Photocopier does not deliver anything TANGIBLE then the transaction is not subject to sales tax. Click here for an example of this rule. I’m pretty confident that if you go to your local FTB office, show them the example above, and ask them for an OPINION on this for photocopiers (and you should), they will agree.

The point here is that copy services and their customers might consider electronically delivered records, with NO transfer of tangible property, to avoid the sales tax issue entirely. Even if the requesting law office might eventually want paper records, the FIRST SET could be delivered electronically and avoid paying sales tax. If the law office later decides they need a PAPER copy or CD, they can always order a second set at the expense of the employer/carrier under C.C.R. 9983(f)(2) and L.C. Section 4620/4622. “Wait…”, you might be thinking, “CCR 9983(f)(2) talks about a second set of records in electronic form, so that doesn’t appear to apply to records delivered on paper or CD.” We will have to wait and see if the WCAB interprets this language differently, but my interpretation is the regulation is only referring to the electronic copy in the COPY SERVICE’S inventory as the deposition officer – see C.C.P. 2020.440. The DWC regulation sets the FEE for the second set, but has no authority (or logical basis) to limit the particular form of transmission media used to convey the requested information from the provider to the requestor.

LIST ON THE INVOICE: The copy service must clearly INDICATE on the invoice that electronic-only delivery was used. If the copy service is audited by the FTB, they will be asked to provide copies of their invoices to the auditor to PROVE the services did not include delivery of tangible property. Also, be sure to ask your local FTB office for a written opinion on this issue specific to your business, and keep this document safe.

HOW TO ELECTRONICALLY DELIVER: There are any number of ways to deliver records electronically, including direct integration with the law office’s case management system, or simply by having the law office open up a Cloud Service, like Google Drive or Dropbox. The requesting law office can SHARE OUT a folder on their Cloud drive to the copy service, and the copy service can simply ‘drop” the PDF of the records on that folder. To keep things organized, the law office or copy service can create a sub-folder for each case… and most cloud services include filename search features to easily jump to a client folder, or a given PDF on the drive. Some cloud services will even provide an automatic email to the law office when records are dropped on their shared folder. Most of the major Cloud providers include super-fast online PDF viewers so you can read the records anywhere and on any device, including full text search tools, collaboration comments, and even annotations. Some even provide end-to-end encryption and access auditing for full HIPAA compliance.

Click here for more discussion on multiple sets...

LIMIT OF TWO SETS AT EMPLOYER EXPENSE: The claims administrator (Payer) is only liable for ONE additional set of records ordered by the injured worker under C.C.R. Section 9982(f)(2), so that’s a maximum of TWO sets of any records that the applicant OR his/her attorney may request at the defendant’s expense.

Some in the industry have taken the position that the injured worker can order an additional set, and then the injured worker’s attorney can order a separate additional set, for a total of 3 sets at the employer’s expense. The problem is the services (each set) must be payable as a L.C. Section 4620 medical-legal expense, and that means the request for an additional set must be INCURRED by a Party to the case… and the applicant attorney is not a separate party from the injured worker. Thus, when the applicant’s attorney orders a set of records from the copy provider, that is the INJURED WORKER ordering that set. The injured worker and his/her attorney are the SAME Party, and C.C.R. Section 9982(f)(2) clearly states, “If the injured worker requests an additional set of records in electronic form ordered within 30 days of the subpoena , the claims administrator is liable for one additional set of records in electronic form for no more than $5.00 for the additional set of records if ordered within 30 days and for no more than $30 if ordered after 30 days and the copy is retained by the registered photocopier. All other additional sets of records are payable by the party ordering the additional set.”

While that paragraph as a whole is confusing and unfortunately written, the STATEMENT made therein that the injured worker is limited to two sets at the defendant’s expense is CLEAR as a bell.

Now let’s look at another category of RECORDS that may not be taxable…

“CERTIFICATE OF NO RECORDS” TRANSACTIONS NOT TAXABLE

Another way copy services might keep sales tax disputes from eroding their fees is to consider invoicing “no records” invoices under C.C.R. 9983(b) without sales tax. When the Records Custodian signs an affidavit under Evidence Code Section 1561(b) stating that no records exist under his/her control, that is not a “copy” of any record that is being re-sold by the Photocopier. It is a written statement that there are NO RECORDS (i.e. tangible property) available. This is a C.C.R. Section 9983(b) “flat fee” of $75 under the Fee Schedule. Under the TECHNICAL reading of the Photocopier Sales Tax regulations, an invoice for services that produced “no records” seems excluded as taxable (tangible) property.

To further support this theory, the following services are ALL that has been performed by the copy provider on a “CNR” service: (1) preparation of the subpoena, (2) service of the subpoena, and (3) payment of the witness fees. All of the above are separately listed items in Article 3, Regulation 1528(b)(2) as NOT taxable. Therefore, a copy provider may want to consider using a description for the line item on a CCR 9983(b) invoice that only includes the above services, and the Billing Code from the Fee Schedule. Again, check with your local FTB office first, but this should satisfy the FTB under an audit that sales tax did not apply.

Click here for an example of a non-taxable line item description...

Consider this line item description to avoid sales tax on a CNR: “WC 021 – Affidavit of No Records. Services under this line item are related to Subpoena preparation, Subpoena service, and Witness Fees only.” That would seemingly comply with the sales tax regulation requirements for listing these types of services separately on the invoice [Article 3, Regulation 1528(b)(2)(C) and (b)(2) and (b)(3)]- while still complying with the fee schedule regulations.

DISPUTING THE ‘TAX DISPUTE” – IBR

Here’s the WORST part of this deal… say the Payer underpays the copy service invoice and fails to pay the 48-cent sales tax on a $5-dollar “Second Set” of records under the fee schedule. That dispute now has to go through IBR (click here), because it’s a dispute over the “amount to be paid under a fee schedule”. That enforcement procedure will cost the copy company the $195 IBR fee, which ultimately has to be reimbursed by the Payer… all over a 48-cents dispute. Even on a $180 “first set” invoice, that’s still a ridiculous expense over such a silly dispute.

Maybe in some situations the Payers actually know they should pay the sales tax but are just trying to get a little more discount off the fee schedule, and figure the copy service will either fail to follow all the steps and timelines defined in Labor Code Section 4622, or not buck-up and pay the $195 IBR fee to collect the last few cents/dollars left on the table. Chances are though, this is really just a case of “lack of understanding” by the Bill Reviewer and Claims Adjusters, so EDUCATE THEM. I hope this post helps everybody in the industry understand a little more about how sales tax plays into copy services fees.

CONCLUSION

The fact that C.C.R. 9983 (Copy Service Fee Schedule) states the fees defined therein are “not including sales tax” does not imply that the fee schedule contradicts California’s sales tax requirements. To the contrary, a reasonable person would have to assume that C.C.R. Section 9983 infers the fees are defined WITHOUT taxes already included, and therefore if sales tax is appropriate, it must be applied IN ADDITION to the defined fees.

To all Claims examiners, Bill Reviewers and Defense attorneys…. you already WON this battle… the applicant copy fees have been reduced now to an effective rate that is very similar to (if not lower than) what we all know defense copy shops have been charging. As long as the applicant copy invoice is calculated correctly under the fee schedule, and the services look legitimate and properly incurred, you should just pay that invoice in full – including the sales tax. In fact, why expend the time and effort (and added expense) of ordering records from a “defense copy shop” yourself anymore? Let the applicant attorney do the research, fill out the order forms, and manage the production of records… and then just order an additional set.

Click here for a PostScript on C.C.R. Section 9990(a)(1) - sales tax charged by the Division when producing records...

I’ve heard there are copy providers that are assuming C.C.R. Section 9990(a)(1) is authority for charging sales tax on a COPY SERVICE invoice. I disagree.

Before the copy service regulations and fee schedule appeared on the scene, some copy services used C.C.R. Section 9990 as authority for ALL their fees. This was because no other “copy and related services” regulations and fees were in existence and ON POINT. Now that the DWC has enacted C.C.R. Sections 9980 through 9984 copy services are limited to their own domain in the regulations.

C.C.R. Section 9990 – the whole SECTION – only applies to the DIVISION of Industrial Relations. The title of this section is “Division Fees for Transcripts; Copies of Documents; Certifications; Case File Inspection; Electronic Transactions.” This section defines entirely separate fees from the copy service fees. The fees and services defined therein are what THE DIVISION may charge for copies of transcripts and records. Trying to use this regulation as authority for sales tax applying to a C.C.R. 9983 “copy service” invoice is the same as trying to argue that applicant copy services can charge $1 per page under 9990(a), or $10 for a certification of records. It simply won’t fly with a Judge or Bill Reviewer – if they are paying attention. I believe the answer to the sales tax dispute is the sales tax code itself, exactly as I’ve described in this post.

There is something I find rather interesting about C.C.R. Section 9990(a)(1) though, and that is the California sales tax regulations, Article 3, Section 1528(b)(2)(B) states that Public Agencies (like the Division) should NOT charges sales tax when providing copies of records. It states:

(B) Public Records. Tax does not apply to charges made by a public agency for photocopies of records furnished pursuant to the California Public Records Act or local law, ordinance, or resolution. Persons who obtain photocopies of public records from public agencies and sell the photocopies are making retail sales and must pay sales tax measured by their entire charge, including reimbursement of legally required fees.

Maybe there is some nuance to how the Division is actually producing their records under C.C.R. Section 9990, but it sure looks to me like they shouldn’t be charging sales tax.